Affinity Tax Experts also provides top-notch Employee Retention Credit (ERC) services in compliance with IRS tax rules and regulations.

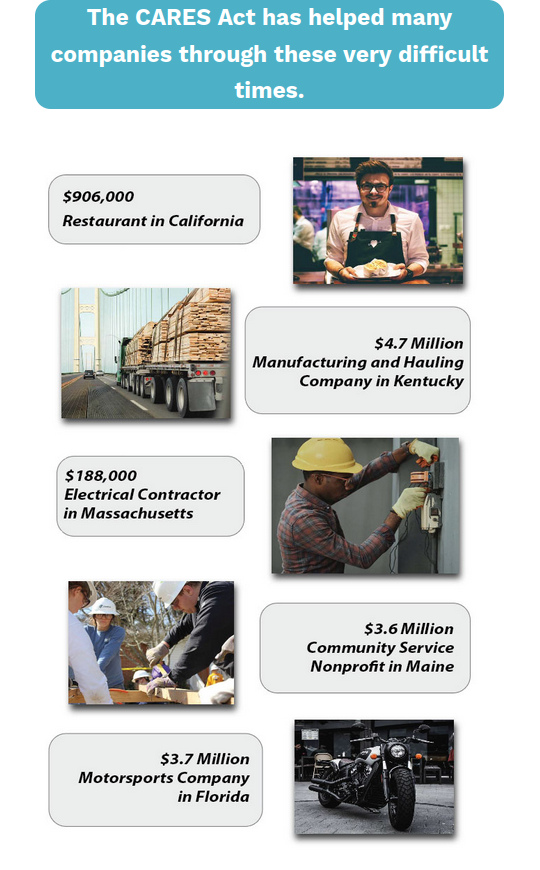

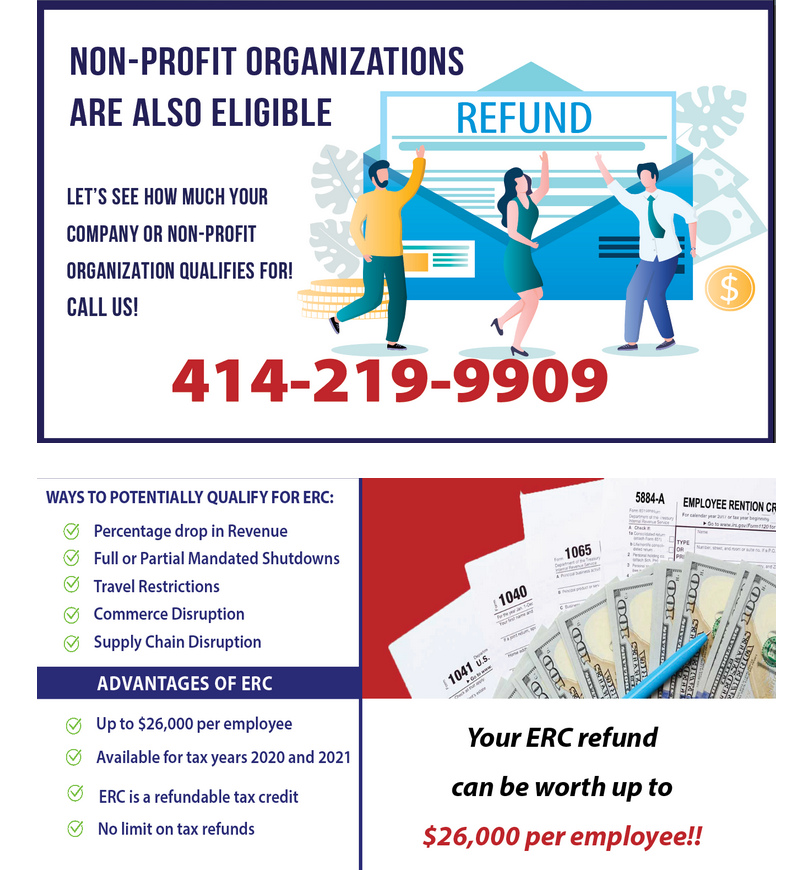

The ERC is part of the government Stimulus Program designed to help those businesses and non-profit organizations that continued paying their employees during part or all of the COVID-19 pandemic. The ERC was established by the CARES Act and it is a refundable tax credit. The credit is available to businesses of any size as well as non-profit organizations. The government has billions of budgeted dollars for these refunds but the time limit to file is closing soon.

YOUR COMPANY OR NON-PROFIT

ORGANIZATION MAY QUALIFY!

We are a licensed, professional specialty tax firm that provides top-notch Employee Retention Credit (ERC) services in compliance with IRS tax rules and regulations.

The Employee Retention Credit underwent several changes during the COVID-19 Pandemic which made it impossible for the average business or non-profit to determine who was qualified to receive the benefits. Hundreds of pages of complex rules and regulations were promulgated which added to the confusion. Our staff has sorted through this maze of rules and regulations for you and we can determine in a short FREE consultation whether you qualify.